Basic Materials Industry Case Study

A Fortune 100 company in the basic material industry sector believes that a sophisticated approach to human capital analytics will help it identify the specific human capital strategies that will lead to improved business performance. Well informed on the human capital analytics topic, yet underwhelmed with the approaches and products in the HR metrics market, the CHRO was intrigued with Vienna’s patented formulas and analytics approach.

The company has in excess of $30 billion in revenue and 13 strategic business units. The CHRO, an innovator by nature, decided to pilot the Vienna Index to test its relevance and potential value to the organization. As innovators know, pilots are low cost, low risk, easy exit approaches to testing new ideas.

The CHRO met with the CFO to get his support for the pilot because the data needed to calculate the Vienna Index values comes from the financial system.. The CFO was also intrigued with the Vienna ROI and Productivity formulas and readily agreed to support the project. In fact he assigned two members of his finance staff to the project team and gave us full access to the entire general ledger and financial system.

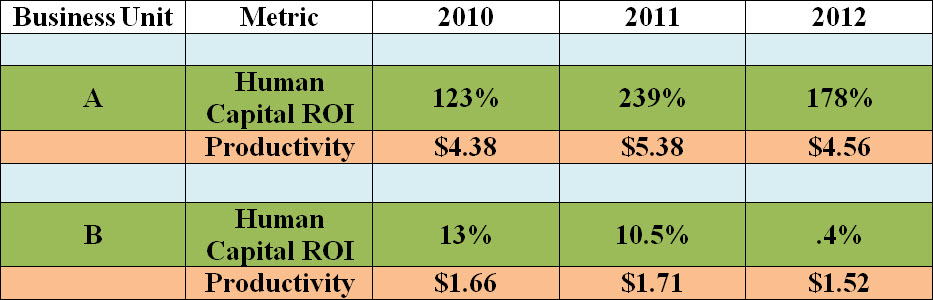

The pilot was conducted on two business units – one very high performing, the other was struggling financially. We gathered the necessary data and measured the results for the three year period ending 12/31/2012. The following table shows the human capital ROI and productivity results for the three year period.

The key observations included:

- Business unit A is performing well, despite a drop in 2012 results compared to 2011. We ultimately determined that 2011 results were unusually high due to cyclical factors and it was unreasonable to expect to continue at such a high level.

- Business unit A’s human capital strategy (Talent, Rewards, Culture and HR Services) needed only minor tweaks to continue to achieve superior performance.

- Business unit B’s performance was both unacceptable and declining. Expected human capital ROI level was 20%. There were several factors driving the results including human capital costs and financial capital costs.

- Business B determined that there were several human capital strategy factors that were hindering performance including where (geographically) work was being performed, staffing ratios (administrative to production), counter-productive financial rewards, and the need to invest in R&D talent to overcome commoditization of their product portfolio.

- To address these human capital issues in Business unit B, a series of human capital strategy actions were adopted that would lead to an annual human capital costs savings of about $70 million.

- The forecasted impact of the human capital savings on shareholder value was $710 million.

The key take-aways from this case study is how the Vienna Index was used by HR to identify an under-performing business unit, and the impact on shareholder value of the changes in human capital strategy.