Financial Services Industry Case Study

A $700 million brokerage firm was growing very rapidly through acquisition, however organic growth was flat. One of the business units ($150 million in revenue) in particular was struggling with organic growth.

The CHRO, familiar with the Vienna approach to human capital analytics, and relatively new to the organization wanted to:

- measure the ROI and Productivity of the financial resources spent on human capital

- compare and contrast the ROI and productivity results of the six geographic regions

- isolate the drivers of the results

- identify the human capital strategy changes necessary to improve performance

- make a compelling business case for the investments need to implement the changes and drive future performance

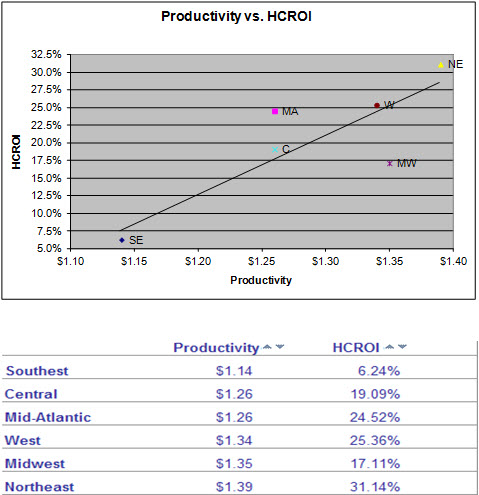

The graphic below shows the performance among the six geographic regions. The highest performing region had productivity of $1.39 generating a human capital ROI of 31%, compared to the lowest performing region which had productivity of $1.14 generating a human capital ROI of 6%.

In collaboration with the CHRO and his team we discovered through:

- analysis of the Vienna Index results

- analysis of a limited body of HR metrics (mostly anecdotal)

- comparison of the differences of the high performing (Northeast) versus low performing (Southeast) performing regions, and

- discussion with business leaders

that the human capital strategy for the business unit was in need of a major overhaul. In total, there were 20+ human capital strategy interventions required. These included:

- consolidation of resources in the Southeast region

- assigning a leader to the business with accountability for financial results and authority to implement necessary changes

- hiring of talent that can drive new client relationships

- developing and implementing a comprehensive leadership development program

- developing and implementing a new performance management program

- restructuring the base and incentive compensation system

We estimated that the investment required to implement these actions was $2 million over a two year period. The CHRO was able to show the GE pedigree CFO — who needed to sign-off on the numbers — that the impact on shareholder value of the investment was $76 million, a 38 times return on investment.

Some of the key take-aways from this case study are:

- how internal comparisons are effectively used to identify the human capital strategies that will drive future business performance

- how limited HR metrics can be used to identify the nature of the productivity and HR ROI problems

- the scope of human capital strategies needed to improve business performance

- how to engage finance to get their enthusiastic support for the human capital investments need to effectively address the business performance issues